China’s July Reserve Sales: Bigger, But Still Not That Big

The proxies for China’s foreign exchange intervention in July are now available, and they point to $20 to $30 billion of reserve sales.

The PBOC’s foreign assets fell by about $23 billion (The PBOC’s foreign reserves, as reported on the PBOC’s renminbi balance sheet, fell by $29 billion; I prefer the change in the PBOC’s foreign assets though, as foreign assets catches the foreign exchange that banks hold at the PBOC as part of their reserve requirement).

More on:

FX settlement with non-banks shows net sales of around $20 billion. Throw in the change in forwards in the settlement data, and total sales were maybe $25 billion.

All the proxies show more variation than appeared in headline reserves, which only fell by $5 billion. I trust the proxies.

The bigger story, I think, is two-fold.

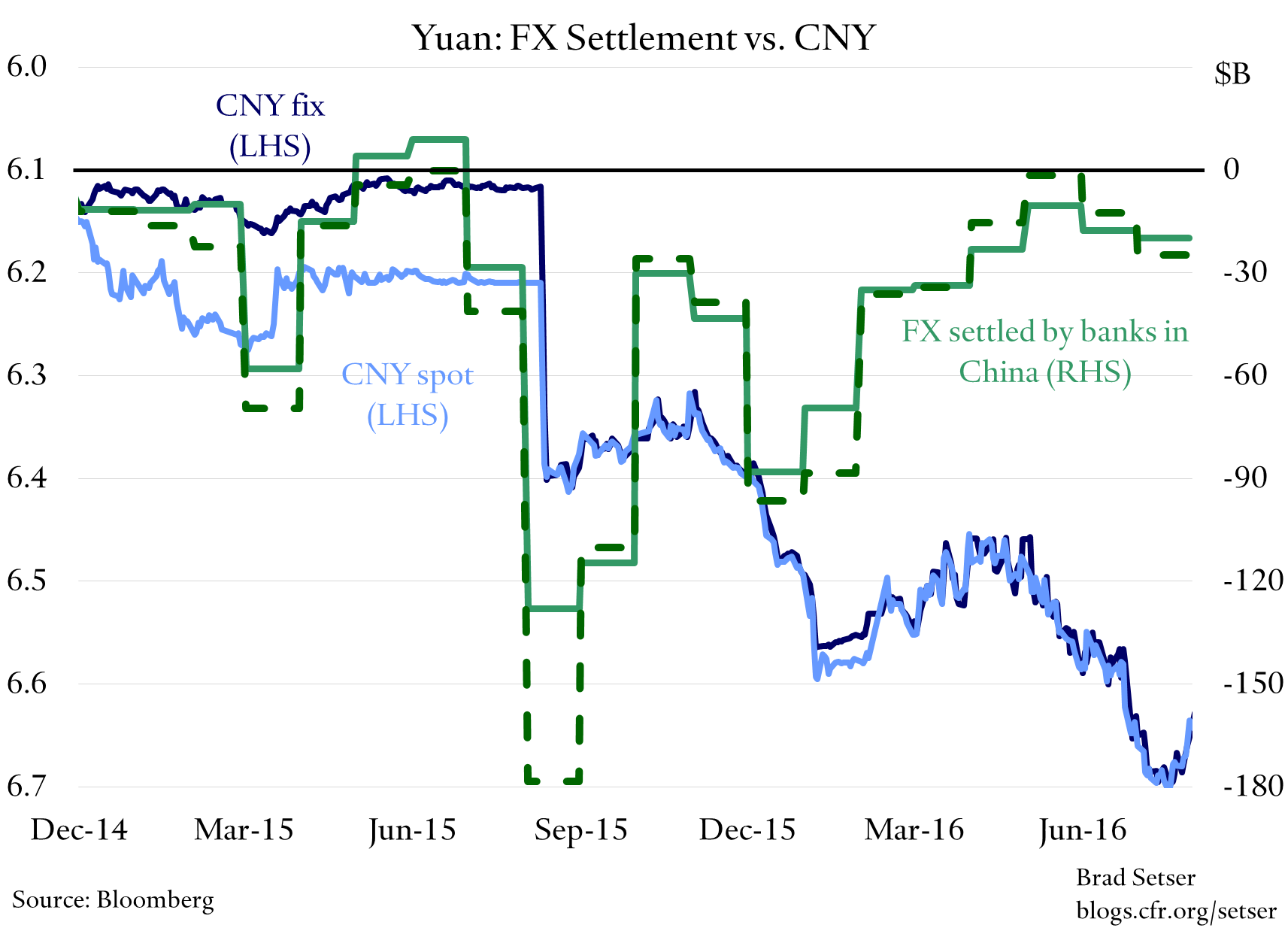

One is that there is still a correlation between FX sales and moves in the yuan against the dollar. In June and July the yuan slid against the dollar, and the magnitude of FX sales increased. That fits a long-standing pattern.

More on:

The second, and far more important point, is that the magnitude of sales during periods when the yuan is depreciating against the dollar are significantly smaller than they were last August, or back in December and January.

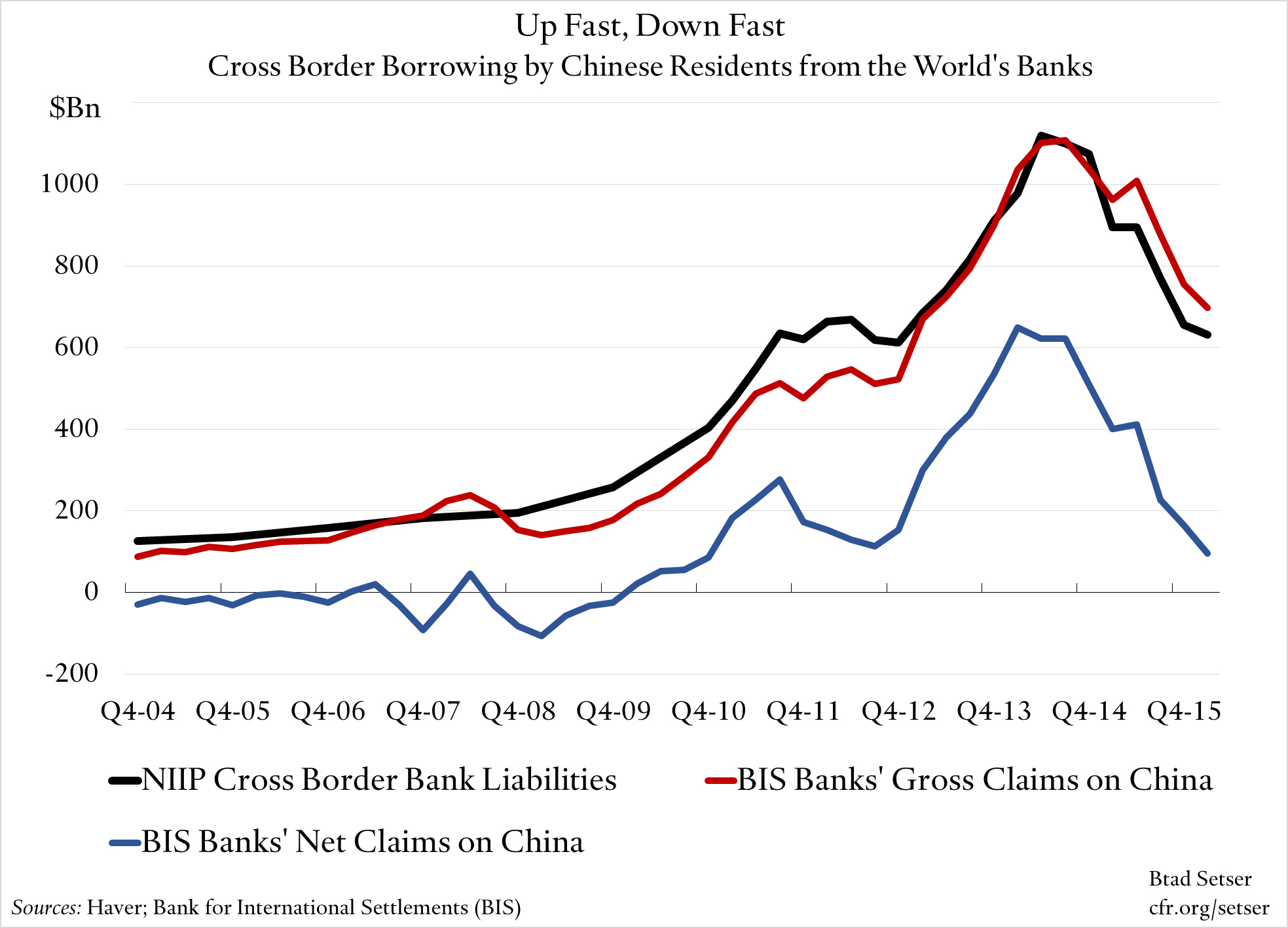

Why? Tighter controls? Or, more simply, has a lot of the foreign currency debt that was built up as part of the carry trade (borrow in dollars to buy yuan to pocket higher interest rates on the yuan) now been paid back, reducing corporate demand for foreign currency in periods of depreciation?

Either way, if a bad month means $20-30 billion in sales, China isn’t going to run out of reserves anytime soon. For now, the desire (or desire, combined with ability to execute) of Chinese savers to hold foreign assets seems to be roughly equal to China’s underlying current account surplus. Hence the broad stability in reserves.

August should be fairly calm on the reserve front. The yuan has appreciated a bit against the dollar recently. And if you squint, you can argue that it also has been stable (rather than slowly depreciating) against a basket, at least for a few weeks. There is no reason to expect large sales.

Online Store

Online Store